MEOS

ManpowerGroup Employment Outlook Survey

Canadian Employers Anticipate a Moderate Hiring Climate in Q1 2026.

❮

❯

Q1 2026 Net Employment Outlook (NEO) for Canada is 18%

More than 1,000 Canadian employers were asked about their hiring intentions for the first quarter of 2026.

The Net Employment Outlook is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting a decrease in hiring activity.

Plan to Hire

Expect to Let Staff Go

Plan to Keep Work Levels Steady

Unsure About Hiring Plans

Net Employment Outlook (NEO)

by Sector for Q1 2026

What is the Outlook for your industry and region?

Q1 2026 NEO:

18

%

*Where a number is asterisked (*) it is indicating a small sample size, and these numbers or comparisons should be treated as indicative only.

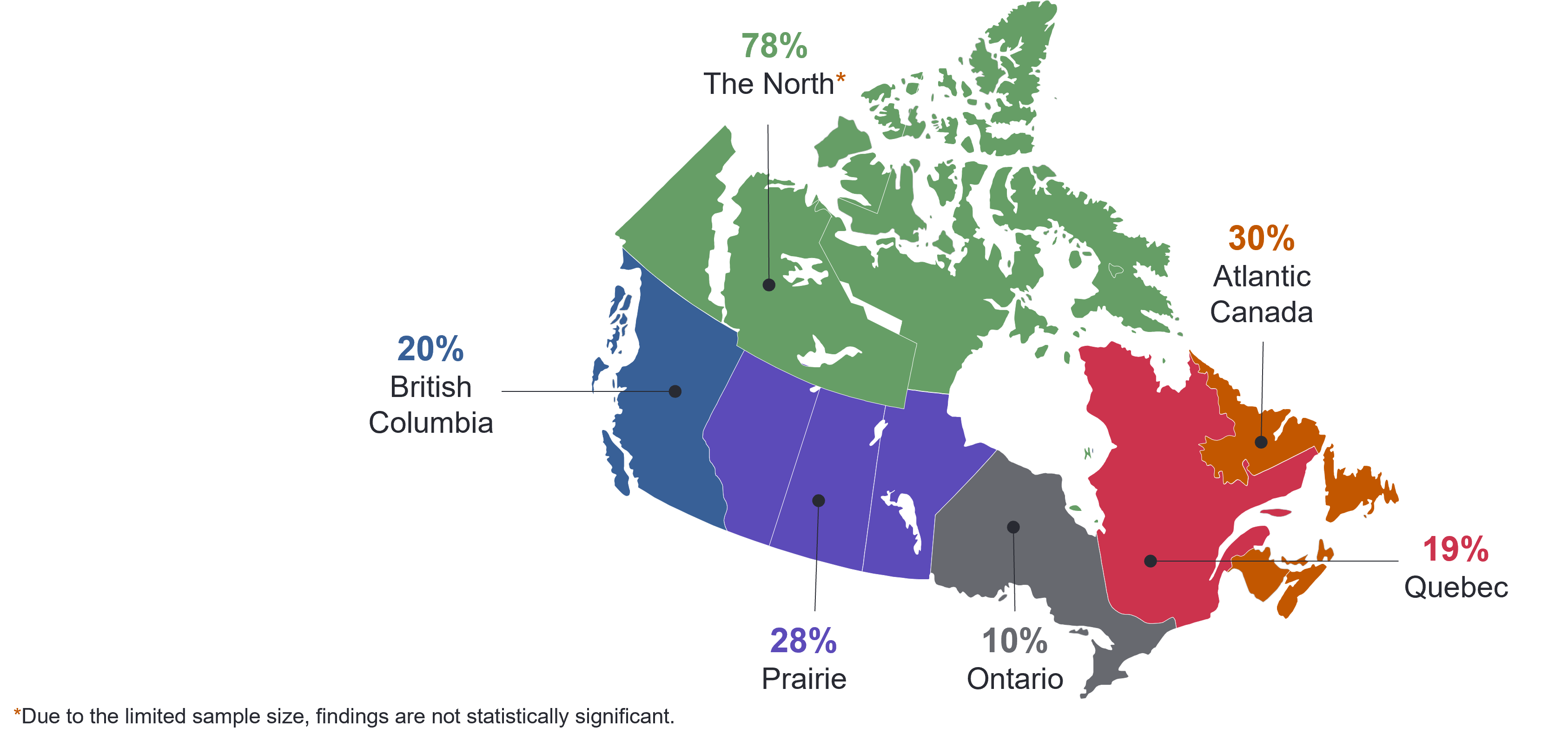

Net Employment Outlook (NEO)

by Region for Q1 2026